Soaring LIBOR Foretells Financial Crisis: Investors Beware

This statement may sound very bold, but it’s worth making: we could be on the cusp of another financial crisis. If this is actually the case, investors need to be extra vigilant. We could see massive declines in asset prices across the board.

Why could there be a financial crisis? As it stands, we are seeing stress build up in the banking sector.

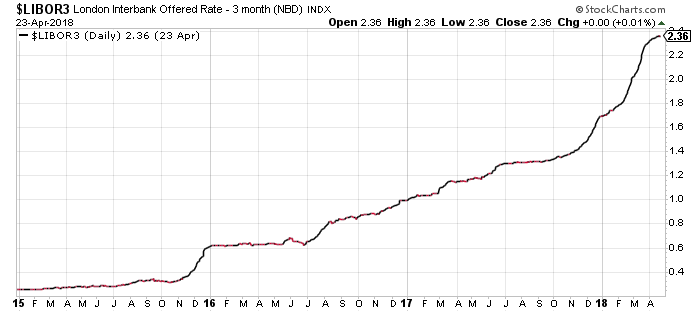

Please look at the chart below of the London Interbank Offered Rate (LIBOR) below.

Chart courtesy of StockCharts.com

What is LIBOR? Think of it as an interest rate for when banks borrow from each other.

As the above chart shows, in 2015, the rate stood at 0.2%. Now it’s at 2.31%. This represents an increase of over 1,000% in a matter of a few years. The chart also shows that, since the beginning of 2018, LIBOR has seen an almost vertical increase.

You see, this interest rate is also considered to be a stress indicator for the financial sector. If it soars, it tells us that stress in the financial sector could be increasing.

Did LIBOR predict the previous financial crisis? Yes.

Just prior to the 2008–2009 financial crisis, we saw LIBOR soar for a while. Between late 2004 and mid-2006, this rate went from around 2.21% to about 5.5%. This increase was in a very vertical manner as well.

What to Look Out for, Going Forward

Dear reader, I completely understand; one could easily say, “LIBOR could be increasing because the Federal Reserve is raising interest rates.”

Yes, if the most basic rates in the economy are increasing, it’s valid to think that. But the pace at which LIBOR is increasing is worth watching, and it’s worrisome too. As I said earlier, the rate has increased by more than 1,000% in the last few years, and it looks like it could soar further.

If LIBOR is correct and there’s a financial crisis brewing, it’s important that investors know the consequences.

A financial crisis usually means asset prices declining across the board and a lot of wealth destruction. In the last crisis, a massive sum of wealth was destroyed, and it could be the case in the next crisis as well.

Let me make it very clear, this is not a recommendation to sell everything whatsoever. Rather, take all of this as a warning of what could be brewing. You won’t hear about this in the mainstream media.

This Could Be the Best Insurance Policy for a Financial Crisis

With all this said, I am keeping a close eye on gold prices.

Gold is usually one of the best insurance policies for a financial crisis. The yellow precious metal provides a lot of safety and protects wealth when investors are panicking and assets are declining in value.

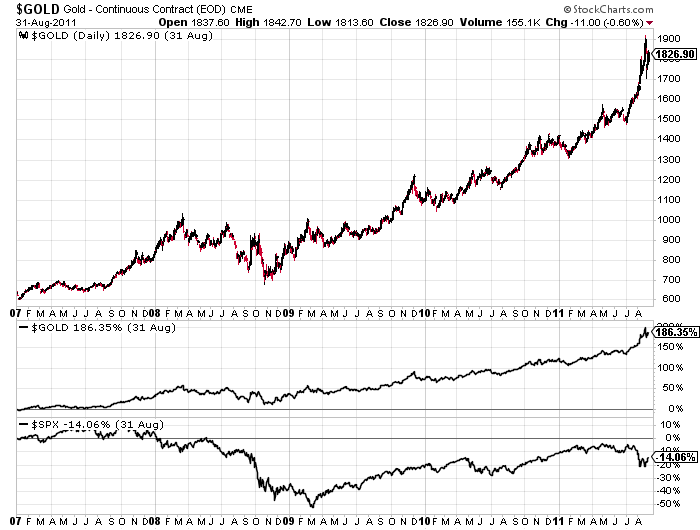

Want proof? Just look at what happened to gold prices between 2007 and 2011. The chart below plots gold prices (top section) and the performance of gold and stocks (bottom two sections).

Chart courtesy of StockCharts.com

In the same time period that gold prices soared 186%, the S&P 500 Index declined by more than 14%.

One of the best things about gold is that it has a solid track record of doing the same thing over and over again for a very long time. In the next financial crisis, gold could be the place to be.